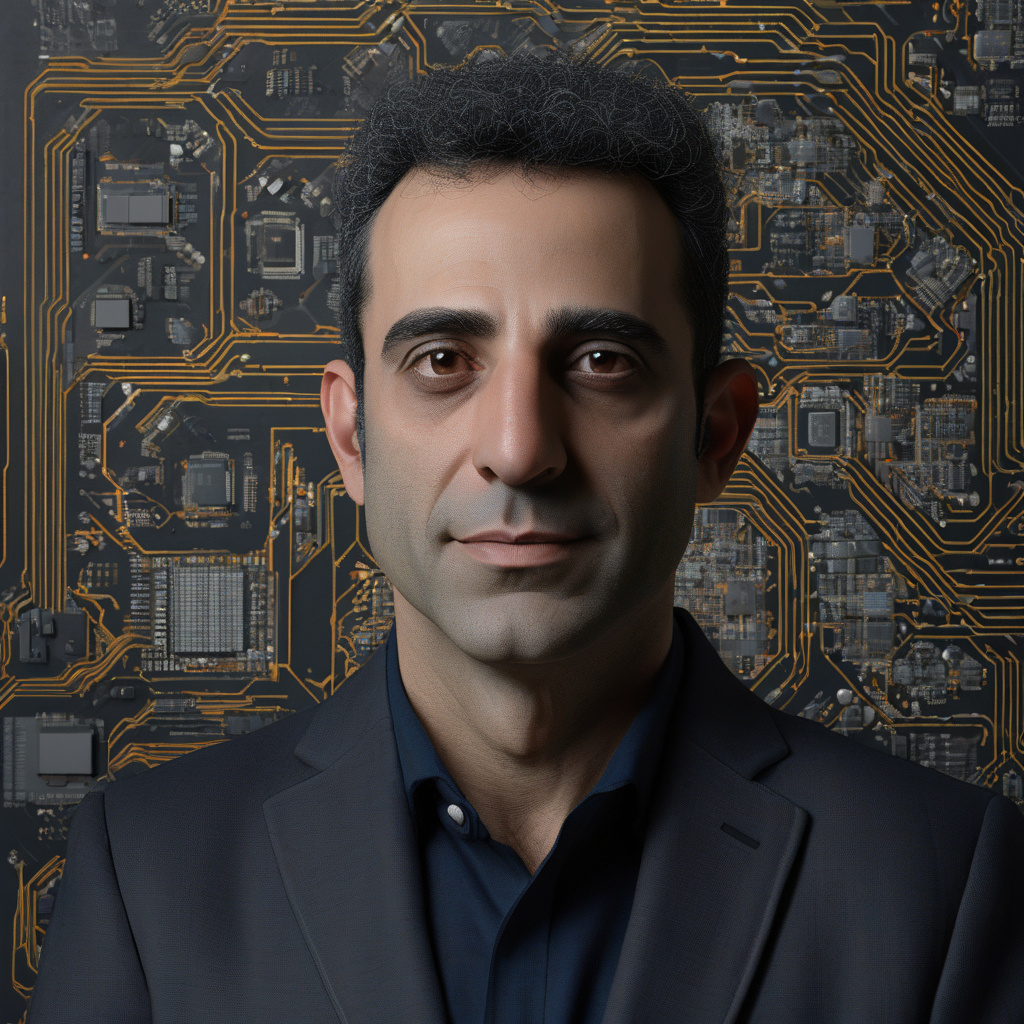

Unlocking the Power of AI in Banking Data with Yuval Samet, CEO and Co-Founder of RiseUp

In the fast-paced world of financial services, leveraging data effectively can mean the difference between thriving and merely surviving. This is where RiseUp, led by its visionary CEO and Co-Founder, Yuval Samet, steps in to revolutionize the landscape. RiseUp is dedicated to empowering financial institutions to enhance assets under management (AUM), deposits, and customer engagement through cutting-edge AI-powered insights.

Yuval Samet’s leadership at RiseUp embodies a commitment to harnessing the potential of artificial intelligence to drive tangible results for banking entities. By providing actionable insights derived from analyzing vast amounts of data, RiseUp enables banks to tailor their strategies with precision, ultimately leading to enhanced financial performance and customer satisfaction.

One of the key advantages that RiseUp brings to the table is its ability to improve customers’ disposable income. By understanding consumer behavior patterns and financial preferences through advanced data analytics, financial institutions can offer personalized services that resonate with their clients. This not only fosters loyalty but also attracts new business opportunities, propelling growth in AUM and deposits.

In a recent interview with TechRound, Yuval Samet shared insights into RiseUp’s innovative approach to leveraging AI for banking data. The ability to extract valuable insights from complex datasets empowers banks to make informed decisions in real time, adapting to market dynamics and customer needs swiftly and efficiently.

By tapping into AI-powered solutions, such as those offered by RiseUp, financial institutions gain a competitive edge in today’s digital-first economy. The transformative impact of data-driven decision-making is evident in the bottom line, as banks witness increased profitability and sustainable growth.

Yuval Samet’s vision for RiseUp goes beyond just data analytics; it encompasses a holistic transformation of how banks engage with their customers. By offering personalized recommendations and tailored financial solutions, RiseUp enables banks to build lasting relationships based on trust and understanding.

As the financial services industry continues to evolve, embracing AI-powered insights for banking data is no longer a choice but a necessity. With leaders like Yuval Samet at the helm, companies like RiseUp are paving the way for a future where data intelligence drives strategic decision-making and unlocks new possibilities for growth.

In conclusion, Yuval Samet’s role as the CEO and Co-Founder of RiseUp signifies a new era in banking data analytics, where AI-powered insights are shaping the future of financial services. By harnessing the power of data to drive innovation and customer-centric strategies, RiseUp is empowering financial institutions to thrive in an increasingly competitive landscape. As we look ahead, the impact of AI in banking data will only continue to grow, underlining the importance of visionary leaders like Yuval Samet in driving industry-wide transformation.